Condo and Homeowner Association (COA/HOA) Insurance Basics

Insurance Guides

Understanding the Different Types of Landlord Insurance

Confused about landlord insurance? Learn all about the four main policy types to help choose the best coverage for your rental property in 2025.

What is a Squatter? 2025 Guide for Property Owners

Discover what a squatter is and how to handle them with our 2025 guide for property owners. Understand squatter rights, their meaning, and possible prevention strategies.

What is Condo Association Insurance?

Discover what condo association insurance is and why you may need it. Learn how it can help protect your building and community.

Meet Honeycomb's CEO at ITI NYC 2024, The World's Leading Insurtech Conference

Ben-Zaken will join the "Perfecting Pricing: Mastering Precision to Ensure Profitability" panel, showcasing Honeycomb's unique approach to Real Estate Insurance

Staying Cool: What Are a Landlord’s Responsibilities Regarding AC?

In hot climates, having an AC or a cooling system is essential, even for rentals. It can also have a big impact on how lucrative the rental property is.

Rent Ledger: What It Is, How to Use One, and a Free Template

Learn what a rent ledger is, why it matters, and how to use one. Download a free rent ledger template for landlords, tenants, and property managers.

Landlord-Tenant Laws in New Jersey

Learn about New Jersey’s landlord-tenant laws, including landlord rights, tenant protections, rent control, eviction rules, and landlord insurance requirements.

Mold in Rental Property: Who Needs to Fix It and How to Prevent It

Many landlord insurance policies have a fungi or bacteria exclusion, meaning that they specifically do not provide coverage for issues related to mold.

Pest Control in Rental Properties: Who Has the Main Responsibility?

Pests can be a real nuisance in any home, but who's responsible for getting rid of them? The answer depends on your lease agreement and where you live.

Knob and Tube Wiring and Insurance: What Property Owners Should Know

Knob and tube wiring is an outdated and potentially unsafe electrical system, leading to high policy premium rates and often refusals to any property with K&T wiring

Additional Insured Explained: Meaning, Benefits, Costs & Use Cases

Learn what “additional insured” means in insurance, why it matters, how much it costs, who’s eligible, and real examples of how coverage works.

The Landlord's Checklist for Tenants Who Are Moving Out

Tenant moving out? Here's a free, printable tenant move-out checklist saves you time and streamlines so you can get your rental unit filled again immediately

Ordinance or Law: ABC Coverage

Ordinance or law is a type of coverage that protects you when you need to rebuild your property according to updated building codes, ordinances and laws

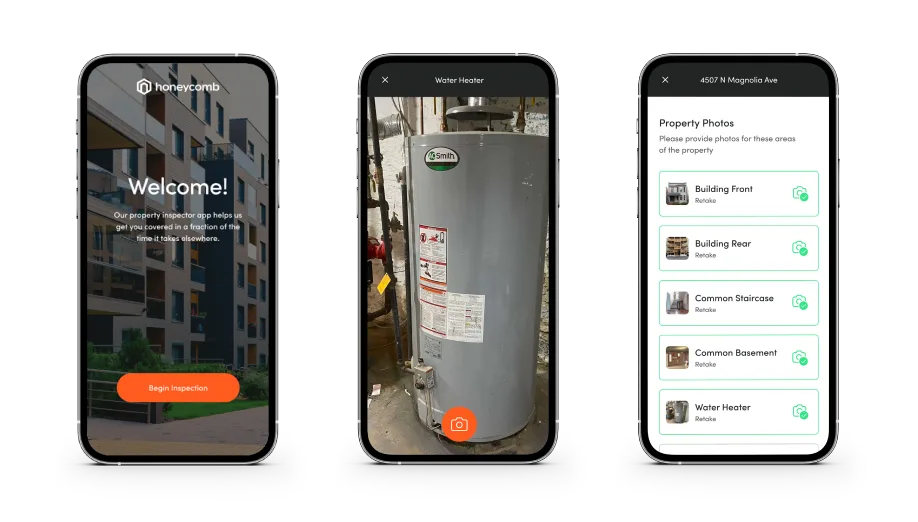

Get started with the Honeycomb Inspector App

The honeycomb inspector app is a powerful tool we use to get you covered in a fraction of the time it takes elsewhere.

Answers to All of Your Real Estate Insurance Questions

Eric Micheals Chief Underwriting Officer

How does the insurance company decide how much I should pay for HOA insurance or an Apartment building master policy?

I have not filed a claim in 20 years, why does HOA insurance premium keep increasing?

Why should I compare multiple HOA insurance quotes from A- or greater rated carriers annually and not just renew our current master policy?

What discounts are available for HOA/Condo Association insurance?

What is your “replacement cost” for HOA insurance and how you should be thinking about it?

What deductible should I select for HOA insurance?

Why does my condo association insurance cost increase every year?

I was just notified that our HOA insurance will not be renewed by our carrier – have we done anything wrong?

Why aren’t there many options to buy HOA insurance online?

“Admitted” vs. “Non-admitted” multifamily insurance – how much it matters for the HOA or building owner?