While shopping for landlord insurance, you don’t want to pay for coverage you don’t need, but you don’t want to leave yourself exposed to dangerous coverage gaps either. Honeycomb Insurance is your one-stop source for an easy-to-use, end-to-end insurance package for your multi-family property. With bespoke coverage options for property and liability, fully customizable policies, affordable rates, and the ability to get quotes in minutes, we’re leading the habitational insurance industry with solutions that work for you.

What is landlord insurance?

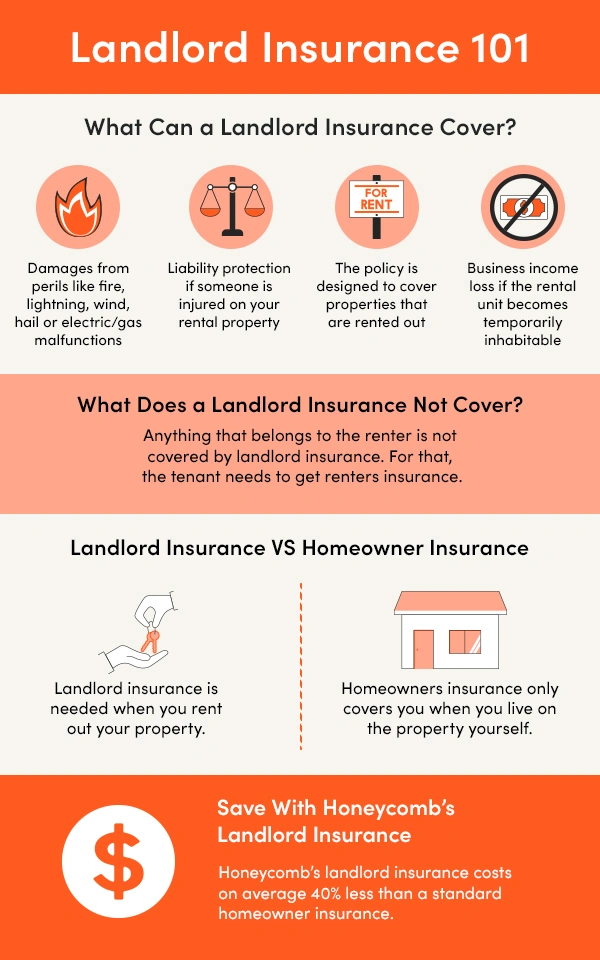

Landlord insurance is NOT the same as homeowners insurance. Standard homeowners insurance typically excludes rental activity. As a landlord, you don’t just need property insurance. You need landlord insurance, which is coverage that’s designed for your rental business activities and the unique risks that come with them.

At Honeycomb, we specialize in landlord insurance. Unlike other insurance companies that take a jack-of-all-trades approach, we don’t sell regular homeowners insurance. Our dedication to landlord insurance means that you can rest easy knowing your needs come first.

Do I need landlord insurance?

Standard homeowners insurance won’t cover your rental activities or related risks. If you want protection from the financial impact of property damage and liability, you need landlord insurance.

Whether you’re actually required to buy landlord insurance will depend on a couple of things. The first is where your property is located. Local and state rules for landlords vary, so review the laws in your area.

The second is whether you have a mortgage. Most lenders have insurance requirements, so if you took out a loan for your property, you’ll probably need to maintain coverage.

Regardless of whether coverage is required, purchasing landlord insurance is a smart way to protect yourself and your investment.

What landlord insurance covers

Your landlord insurance package will include several coverage types designed for your risks. The exact details of your coverage will vary, but here are some key protections that Honeycomb policies can provide:

Property insurance

Property coverage is a key part of your landlord insurance policy, and it covers the property you own against physical damage. For example, if your property is damaged in a fire, you can file an insurance claim to cover the repair costs, up to your policy limit. Dwelling coverage specifically covers damage to the building structure itself. You should purchase limits that are high enough to cover the replacement cost of your property.

Landlord liability insurance

Liability insurance is another key part of any landlord insurance policy. A typical example of liability involves a tenant or guest who is injured on your property. If the injury is considered your fault – for example, because you failed to maintain the front steps and a broken step created a tripping hazard – you could be held liable for the medical costs. You could also face legal costs if the injured person files a lawsuit. Landlord liability insurance can help cover the medical and legal costs associated with third-party liability.

Business income coverage

If your rental property is badly damaged, you’re not just facing repair costs. You’re also facing lost income. Business income coverage provides important protection for landlords who depend on their rental properties for income.

Certified terrorism coverage:

Some policies do not cover acts of terrorism. However, landlords can secure terrorism insurance for acts that have been certified as terrorism events by the U.S. government.

Coinsurance requirements

Many property insurance policies, including landlord insurance policies, include coinsurance requirements. You are expected to insure your property for its full value. If you insure your property for less than its full value, you are agreeing to self-insure a percentage of your property.

If you experience a total loss, being underinsured means you have to pay the difference out of pocket. With a coinsurance clause, you will also be expected to cover a portion of smaller losses out of pocket, even if the loss amount is less than your limit, based on the percentage that you have underinsured the property for.

For example, if you’ve only purchased coverage for 70% of your property value, then your policy might only pay 70% of the claim value less the deductible. To avoid a coinsurance penalty, make sure to secure policy limits that are high enough to cover the full value of your property. You may need to adjust your insurance limits annually to keep pace with changing property values.

What landlord insurance does not cover

Landlord insurance policies typically do NOT cover the following:

Tenant belongings

Your landlord insurance policy covers your belongings, not your tenants’ belongings. Your tenants should secure their own renters insurance policy if they want coverage for their own stuff, such as their furniture, electronics, clothes and jewelry. In states where it is permitted, many landlords include insurance requirements for tenants in the lease.

Property you share

If you own and live in a house and rent out a room in that house, your insurance needs are different. Talk to your homeowners insurance provider about your situation.

Home appliances

Your appliances have a limited life span, and over time, they will break down. A standard landlord insurance policy does not provide coverage for equipment breakdown.

Damages from certain perils

In a named-perils policy, only the perils that are listed in the policy are covered. In an all-risk policy, all perils are covered unless they are specifically listed as excluded in the policy. Regardless of the type of policy you have, you can expect certain perils to be excluded from coverage. For example, standard property policies do not provide coverage for earthquakes or other land movements. Some types of water damage, such as damage caused by a burst pipe, are commonly covered, but flood damage is not covered under standard property insurance. These coverages can be purchased separately.

Damage that comes from normal wear and tear or a lack of maintenance will not be covered, and infestations of bedbugs or other pests are also typically excluded. War and nuclear hazards may be excluded, as well. Some additional exclusions are specific to the region. For example, many policies include coverage for wind damage from hurricanes, but in some areas, this coverage is provided under a separate policy. You policy may have additional exclusions, such as exclusions for certain dog breeds that are considered dangerous, so see your policy for details.

How much does landlord insurance cost?

Because of the additional risks involved, landlord insurance tends to cost more than homeowners insurance. How much you pay will depend on many factors, including:

- The property: It will obviously cost more to insure a large 100-unit property than it will to insure a modest four-unit building. However, size isn’t the only thing that matters. The age and construction of your property will also impact the cost.

- The location: In real estate, location is everything. Fire, hurricanes, tornadoes and other risks vary from region to region, so your location will impact your insurance rates.

- The limits: Higher limits will cost more, so if your property has a high value, you can expect to pay more for insurance. However, this isn’t an area where you want to cut corners. It’s important to secure limits that are high enough to cover the full replacement cost of your property. This will protect you in the case of a total loss. It will also help you avoid the coinsurance penalty for smaller losses.

- The deductible: The deductible is the amount that you have to cover out of pocket if you file a claim. If you have funds available to cover an unexpected loss, choosing a higher deductible can be a good way to lower your premium. However, make sure you have enough resources to cover the deductible you choose. Also, pay attention to different deductibles in your policy. For example, your policy may have a separate deductible for wind and hail damage.

- The coverage types: Adding on additional coverage types provide better protection, but it also raises your rates.

Additional coverages to consider

- Ordinance or law: A standard property insurance policy cover the costs to rebuild your property to its previous state. However, you may be legally required to upgrade your property to meet new building codes. Ordinance or law coverage helps pay for the additional costs. This add-on can be especially important for landlords who own older buildings that pre-date current building codes.

- Directors and officers: The people who serve as directors and officers at a company can face personal liability for their actions. D&O insurance provides coverage.

- Employment practices liability: is the liability of an employer for an error or omission in the administration of an employee benefit program, such as failure to advise employees of benefit programs.

- Equipment breakdown: Replacing a HVAC unit or other appliance can be a major expense. A standard property insurance policy does not cover mechanical breakdowns, but equipment breakdown coverage is available as an add-on. If you don’t have funds for unexpected equipment malfunctions, this is an important add-on to consider.